If it’s time for a career change, you might be considering becoming a loan signing agent in Tennessee. This type of career can help you earn a nice salary, gain some freedom, and enjoy what you do for a living.

There are specific steps you will need to follow to become a loan signing agent in Tennessee. Of course, you should understand the job duties of this position first.

Job Duties of a Loan Signing Agent in Tennessee

As a loan signing agent, you will also be a Notary Public. One of your main job duties will be providing notary services for those signing loan documents. Typically, loan signing agents in Tennessee work in the real estate industry.

You will likely spend your time working with those signing mortgage documents for home purchases and refinances. It’s common to walk them through the documents showing them where to sign and initial. It will also be necessary to verify the identity of the signors.

Loan signing agents won’t provide any professional or legal advice, however. Once the documents are properly signed and notarized, you will deliver them back to the escrow company.

How To Become a Loan Signing Agent in Tennessee in 9 Steps

Step #1 – Meet the Basic Requirements in Tennessee

The state of Tennessee requires you to be at least 18 years of agent, and you must be a U.S. citizen or a legal permanent resident to become a loan signing agent. It’s also necessary to live or work in the state. All loan signing agents will also need to read and write English.

As long as you meet these basic requirements, you can follow the rest of the steps to become a loan signing agent in Tennessee.

Online Notary Training » Notary.net

Online Notary Training » Notary.net

If you’re looking to become a notary or renew your notary commission, we offer Online Notary Courses for 46 states and Notary Supplies for all 50 states.

Step #2 – Visit Your County Clerk’s Office

It’s necessary to visit your county clerk’s office and apply to become a Notary Public in Tennessee. You will have to fill out the form with basic information and pay a $12 application fee.

Step #3 – Submit Your Application to the Secretary of State

Once you complete your application, you will need to submit your application to the Tennessee Secretary of State. The county clerk will have certified your application before you submit it.

The Secretary of State will be in charge of granting your notary commission, and they hold all records, too. Once you have an approved application, the Governor and the Secretary of State will sign your commission. It will also be sent back to the country clerk, and you will be notified when they receive it.

Step #4 – Get a Surety Bond

It’s required in the State of Tennessee that all Notary Publics have a $10,000 surety bond with a four-year term. This surety bond can be purchased through an insurance company or notary bonding company.

A surety bond protects those you provide services for, but not you. If you want protection for yourself, you will need to get Error & Omission insurance or E&O coverage.

Step #5 – Complete the Oath of Office

After you show proof of your surety bond to the County Clerk, you will need to take an oath of office. As soon as you complete your oath, you will be issued a Notary Commission Certificate. Make sure all the information on the certificate is correct.

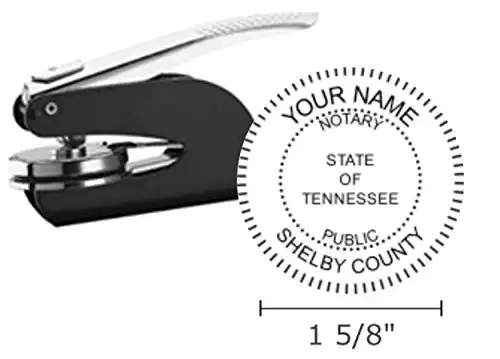

Step #6 – Get Your Official Seal

You will need to get a stamp or seal for all notary services. It will need to comply with the regulatory rules and can be purchased from an office supply store or the county clerk’s office. The seal must be kept in a secure area where only you have access to it.

|

$24.99

|

$23.99

|

N/A

|

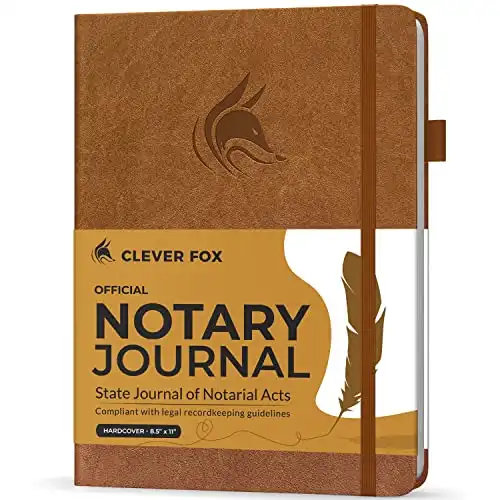

Step #7 – Keep A Notary Journal

You will be required to keep a notary journal in Tennessee. This journal will include all the notary services you have provided with specific information based on the regulations for the state.

|

$26.99

|

$9.99

|

|

Step #8 – Complete Loan Signing Agent Training

While all of the steps have been about getting your Notary Public, which is important, you still need loan signing agent training. Without good training, you may not be able to make as much money as you would like. It can also be hard to figure out how to get appointments.

Good loan signing agent training will give you the skills you need. You will learn how to land more appointments, finish your appointments faster, and charge more per appointment.

Online Notary Training » Notary.net

Online Notary Training » Notary.net

If you’re looking to become a notary or renew your notary commission, we offer Online Notary Courses for 46 states and Notary Supplies for all 50 states.

Step #9 – Become an Online Notary in Tennessee

When you become an Online Notary in Tennessee, you even have to meet the signor to provide your services. This can be a very important skill to add to your business. It will require you to be an active Notary Public, and you will have to get the right technology.

Along with the technology, you will need to submit another application with a $75 fee to the Secretary of State. Once this is approved, you will receive your online notary public commission.

Of course, you want to make sure you learn the online notary rules. You can learn the rules from Chapter 1360-07-02 Online Notaries Public in the Tennessee Department from the State Division of Business Services.

It’s a nine-page guide that will cover all the necessary rules for Online Notary in Tennessee. You will need to keep electronic notarization records for at least five years.

Frequently Asked Questions About Loan Signing Agents in Tennessee

How much can I earn as a loan signing agent in Tennessee?

According to ZipRecruiter.com, you can earn about $23 per hour or $47K per year as a loan signing agent in Tennessee. Salary.com puts the median salary at about $35K, with a range from about $33K to $53K.

However, if you want to make even more, you can do so by getting the right training. With good loan signing agent training, you can earn $75 to $200 per appointment. Some loan signing agents earn more than $10K per month after training.

What will it cost me to become a loan signing agent in Tennessee?

There are several costs that go along with becoming a loan signing agent in Tennessee. You will need to become a Notary Public, which will come with a $12 application fee, a $17 fee for your seal, and a $15 fee for your journal. This also requires a surety bond, which can vary in cost but will run about $90, if you also get E&O insurance.

Those opting to become an Online Notary will pay another $75 application fee, too. The cost to become a Notary Public will range from about $75 to $200.

Becoming a loan signing agent will also require the right training if you want to be successful. Good online training will range from about $200 to $400.

You will likely have other expenses, too, such as remote notary technology, a computer, business supplies, and travel expenses.

What type of education do I need to become a loan signing agent in Tennessee?

You don’t need any education to become a loan signing agent in Tennessee. There is no training course for Notary Public commissions in the state. However, if you don’t get the right loan signing agent training, you might struggle to become successful.

While no education is necessary, good training can go a long way. You will also want to learn the rules and regulations for Notaries Public.

Online Notary Training » Notary.net

Online Notary Training » Notary.net

If you’re looking to become a notary or renew your notary commission, we offer Online Notary Courses for 46 states and Notary Supplies for all 50 states.

How long will it take me to become a loan signing agent in Tennessee?

The process will include becoming a Notary Public. This can take a week or two, depending on how long it takes to get your application approved. It can also vary from one county to another.

Often, you can finish all the different steps, including loan signing agent training, in less than three weeks.

When will I need to renew my notary commission in Tennessee?

Part of being a loan signing agent is renewing your notary commission in Tennessee. This has to be done every four years and your online notary commission will expire at the same time.

You will be able to renew in advance of your expiration date to ensure there is no interruption to your business.

Does Tennessee allow felons to become loan signing agents?

If you have a felony on your record, it may not mean you are automatically declined. The Secretary of State takes these applications on a case-by-case basis for review. They must make sure you are truthful and credible.

You cannot have been removed from the office of Notary Public in the past or have had a notarial commission revoked or suspended in another state. If you have been found guilty of engaging in the unauthorized practice of law, you will also be disqualified.

When you’re ready to learn how to become a loan signing agent in Tennessee, you just need the steps above. It can take a few weeks to go through the process, but it’s a pretty easy career to get started in.